Alphabet reported second-quarter results on Wednesday that beat on revenue and earnings, but the company said it would raise its capital investments by $10 billion in 2025.

Here’s how the company did, compared with estimates from analysts polled by LSEG:

Wall Street is also watching several other numbers in the report:

The company’s overall revenue grew 14% year over year, higher than the 10.9% Wall Street expected, but Alphabet is going to spend more on artificial intelligence in 2025 than it anticipated.

In February, the company said it expected to invest $75 billion in capital expenditures in 2025 as it continues to expand on its AI strategy. That was already above the $58.84 billion Wall Street expected at the time.

The company increased that figure on Wednesday to $85 billion, saying it was raising it due to “strong and growing demand for our Cloud products and services.” The company expects to further increase capital expenditures in 2026, Alphabet finance chief Anat Ashkenazi said on an earnings call.

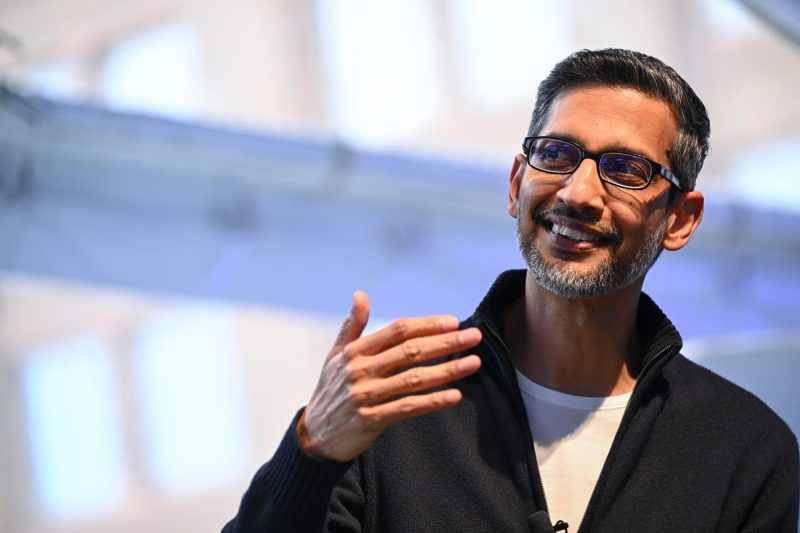

The company reported revenue of $13.62 billion for its cloud computing business, which is a 32% increase from a year ago. Last week, OpenAI announced that it expected to use Google’s cloud infrastructure for its popular ChatGPT service. Alphabet CEO Sundar Pichai said “we are very excited to be partnering with them.”

Alphabet’s net income increased to $28.20 billion, up nearly 20% from the previous year.

The company’s search and advertising units still showed growth in the second quarter despite AI competition heating up. The company’s search unit brought in $54.19 billion during the quarter, and its advertising revenue grew to $71.34 billion — up about 10.4% from $64.61 billion the year prior.

YouTube advertising revenue came in at $9.8 billion, higher than Wall Street expected.

The company said its “Other Bets” segment, which includes its self-driving car unit Waymo and life sciences unit Verily, brought in $373 million — up from $365 million a year ago. Other Bets reported a loss of $1.25 billion, up from the $1.13 billion a year ago.

AI Overviews, Google’s AI search product that summarizes search results, now has upward of two billion monthly users across more than 200 countries and territories, Pichai said during Wednesday’s earnings call. That’s up from 1.5 billion monthly users last quarter.

The Gemini app, which has the company’s AI chatbot, now has more than 450 million monthly active users, Pichai said.

When asked about large spending on AI talent, Ashkenazi said Alphabet makes “sure that we invest appropriately to have the best and brightest minds in the industry.”

Google made a splash in the AI talent wars, announcing earlier in July that it would bring in Windsurf CEO Varun Mohan and other top researchers at the AI coding startup as part of a $2.4 billion deal that also includes licensing the company’s technology.

Total operating expenses increased 20% to $26.1 billion, Ashkenazi said on Wednesday. The biggest driver of growth was expenses for legal and other matters due in part to a $1.4 billion charge related to a settlement, she said on Wednesday’s earnings call. Texas Attorney General Ken Paxton in May announced a $1.37 billion settlement with Google related to a data privacy rights lawsuit it made against the company in 2022.

Ashkenazi said Alphabet’s third-quarter revenue “could see a tailwind” due to several reasons. That includes a negative impact for advertising, which benefited from “strong spend on U.S. elections” in late 2024, particularly on YouTube, she said.